Stonewell Bookkeeping Can Be Fun For Everyone

A Biased View of Stonewell Bookkeeping

Table of Contents6 Easy Facts About Stonewell Bookkeeping ExplainedStonewell Bookkeeping Things To Know Before You Get ThisStonewell Bookkeeping Fundamentals ExplainedEverything about Stonewell BookkeepingWhat Does Stonewell Bookkeeping Do?

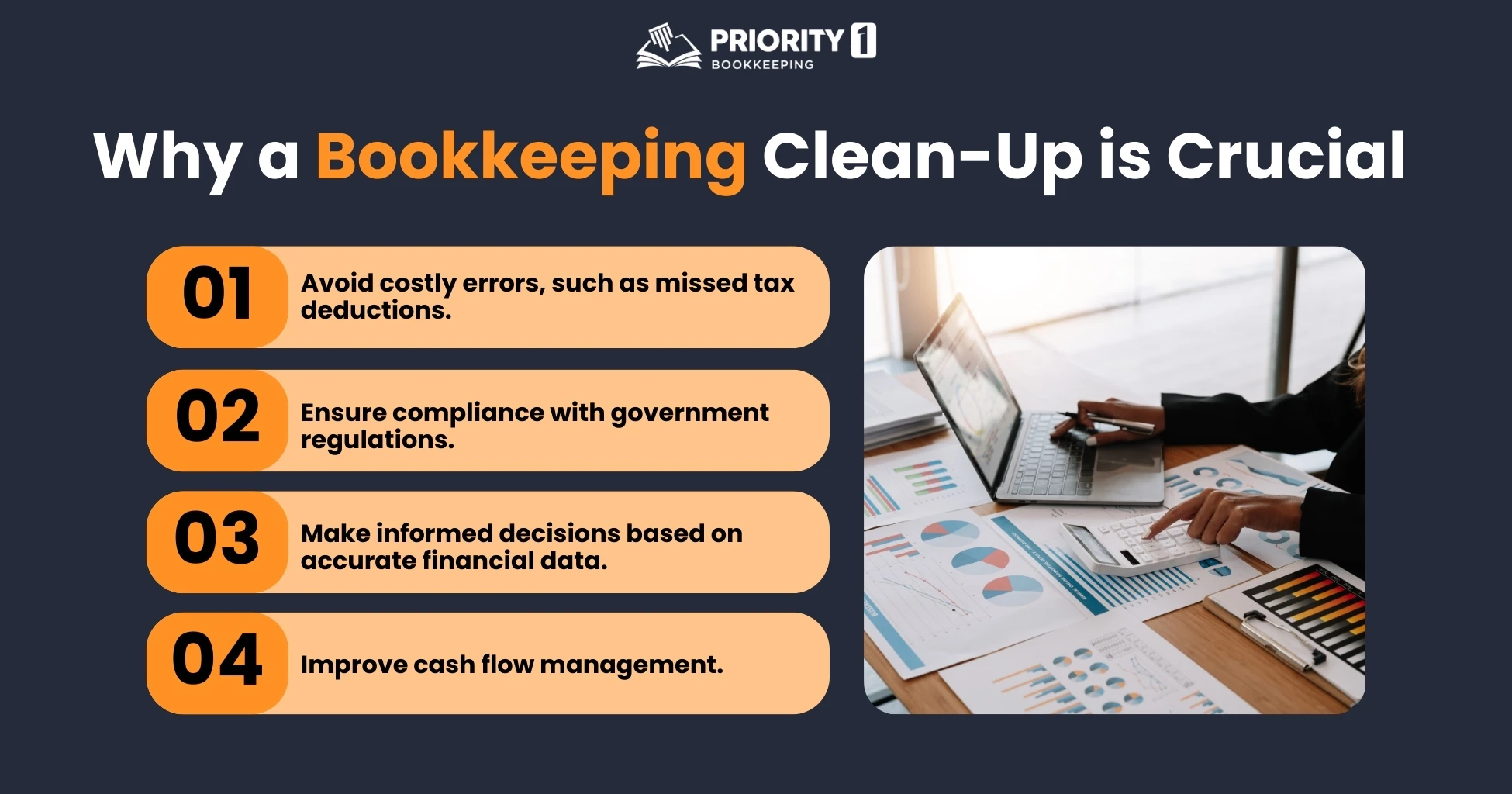

Rather of undergoing a declaring cabinet of different papers, billings, and receipts, you can present in-depth documents to your accounting professional. In turn, you and your accountant can conserve time. As an included benefit, you might also be able to determine possible tax obligation write-offs. After utilizing your audit to file your taxes, the IRS may select to perform an audit.

That financing can come in the form of owner's equity, grants, company financings, and capitalists. Financiers need to have an excellent concept of your company prior to spending.

Rumored Buzz on Stonewell Bookkeeping

This is not planned as legal advice; for more details, please click on this link..

.webp)

We responded to, "well, in order to recognize how much you require to be paying, we need to know just how much you're making. What are your revenues like? What is your earnings? Are you in any financial debt?" There was a lengthy pause. "Well, I have $179,000 in my account, so I guess my earnings (earnings much less expenditures) is $18K".

Stonewell Bookkeeping Things To Know Before You Buy

While it could be that they have $18K in the account (and also that might not be true), your balance in the bank does not always identify your profit. If somebody obtained a grant or a finance, those funds are not taken into consideration revenue. And they would certainly not infiltrate your earnings statement in establishing your revenues.

Many things that you think are expenses and reductions are in reality neither. Accounting is the procedure of recording, classifying, and organizing a firm's monetary purchases and tax filings.

An effective service needs aid from professionals. With reasonable objectives and an experienced accountant, you can easily resolve challenges and maintain those concerns at bay. We commit our energy to guaranteeing you have a solid economic structure for growth.

Stonewell Bookkeeping for Dummies

Exact accounting is the foundation of excellent financial monitoring in any kind of company. With good bookkeeping, organizations can make much better choices since clear monetary documents offer beneficial information that can assist strategy and enhance earnings.

Solid accounting makes it easier to safeguard financing. Accurate economic statements develop trust fund with lenders and investors, enhancing your possibilities of getting the capital you require to expand. To keep strong financial health, businesses need to frequently integrate their accounts. This suggests matching transactions with financial institution declarations to catch errors and prevent economic discrepancies.

They assure on-time settlement of costs and fast customer negotiation of invoices. This enhances cash flow and aids to avoid late penalties. A bookkeeper will certainly cross financial institution statements with interior documents at the very least once a month to locate mistakes or incongruities. Called bank reconciliation, this procedure guarantees that the useful content monetary documents of the company suit those of the bank.

Money Circulation Declarations Tracks cash money motion in and out of the business. These records help service owners understand their monetary placement and make informed choices.

The Definitive Guide to Stonewell Bookkeeping

The very best selection depends upon your budget plan and company demands. Some local business owners prefer to deal with bookkeeping themselves utilizing software program. While this is cost-effective, it can be time-consuming and prone to errors. Tools like copyright, Xero, and FreshBooks enable company owner to automate bookkeeping tasks. These programs aid with invoicing, financial institution reconciliation, and economic reporting.